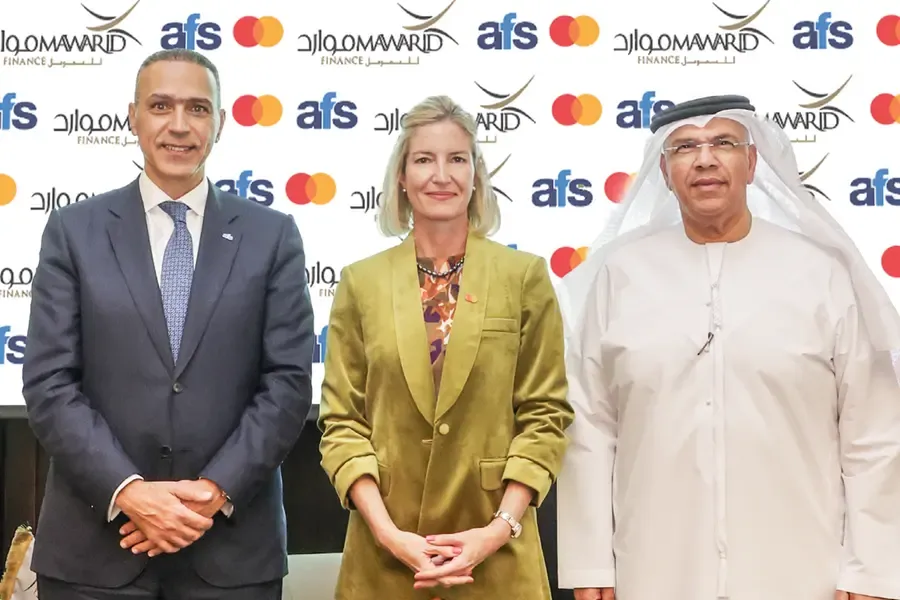

Manama, Bahrain – In a pioneering move set to reshape fintech innovation in the UAE, Mawarid Finance and Arab Financial Services (AFS) today signed a strategic agreement to launch an integrated Fintech Enablement Hub, a unified platform designed to empower fintechs with seamless access to regulated infrastructure and next-generation digital capabilities.

This collaboration combines global technology leadership, BIN sponsorship, and advanced processing capabilities into one integrated framework. The initiative simplifies how fintechs bring card programs to market by merging scheme connectivity, issuing, processing, and enablement tools onto a single, frictionless platform.

The partnership leverages Mastercard Product Express, a platform designed for fintechs, enabling the innovation necessary to meet their customer needs, and helping reduce their time to market by providing them with the tools, resources and partners required to launch and scale. The Product Express platform allows fintechs to easily select the product that best meets their needs, choose plan-certified partners ready to implement, e.g. with live BINs and pre-approved card designs, and the ability to track progress in full transparency across all steps to be completed by all parties. This allows them to drastically reduce the time to market with the platform providing a way for fintechs to launch card programs in as fast as 15 days.

Rashid Al Qubaisi, Chief Executive Officer of Mawarid Finance, said, “This collaboration places Mawarid Finance at the core of a best-in-class fintech enablement model in the UAE. As BIN sponsor, we are proud to provide the regulatory and operational foundation that allows fintechs to move from concept to card issuance with speed, security, and full compliance. This partnership reflects our commitment to supporting national innovation goals by empowering new business models and creating real pathways for growth, scale, and market impact.”

Samer Soliman, Chief Executive Officer of AFS, remarked that: “’By leveraging our deep technological expertise, AFS delivers a unified, frictionless platform that dramatically accelerates time-to-market for card programs. This empowers the next wave of digital-first companies to build, launch, and scale their solutions with optimal agility and confidence”.

This collaboration marks a major step toward advancing digital enablement in the UAE, offering fintechs a clear, streamlined path to build and scale card products all within a single, unified experience.

About AFS:

Arab Financial Services (AFS) was formed in 1984 to provide payment products, services and expertise to banks and merchant groups and deliver customized payment solutions in an increasingly divergent, disruptive, and dynamic payment ecosystem.

AFS is owned by 37 banks and financial institutions and serves over 60 clients in more than 20 countries across the Middle East and Africa. Today, AFS is the region’s leading digital payment solutions provider and fintech enabler. Regulated by the Central Bank of Bahrain and the Central Bank of Egypt and licensed by the Central Bank of UAE, its dedication to innovation has made AFS a driving force in the market offering a rich portfolio of payment solutions including Open Banking Hub, popular digital wallets, market-leading merchant acquisition services, digital payroll solutions and more. Providing the highest quality payments solutions that are trusted by businesses, AFS has offices and data centers in the Kingdom of Bahrain, Arab Republic of Egypt, Sultanate of Oman, and the United Arab Emirates.

About Mawarid:

Mawarid Finance PJSC is an Islamic finance and investments group licensed by the UAE Central Bank. Mawarid Finance was formed in 2006 in Dubai, United Arab Emirates, with a paid-up capital of AED 1 billion to launch a new vision in Islamic Finance by adding more value to the industry through developing innovative Shariah compliant products for both individual and corporate customers Mawarid was founded upon and continues to believe in Innovation. We aim to be different, unique and ‘special’ in everything we do. Mawarid’s focus has also been on supporting and developing the national economy through the provision of Islamic financial products and services for small & medium enterprises, enabling them to grow and in turn fostering the growth of the economy.

Over the years, Mawarid’s strategic approach has been on emerging from an Islamic financial services company to a Conglomerate building synergy through the acquisition of complimentary and supplementary shariah compliant businesses. Today, Mawarid maintains a healthy and well diversified portfolio of investments across a wide spectrum of industry sectors and asset classes across the MENA region Mawarid Finance in its young history has collected several awards, locally and internationally, in business, gained ISO 9001:2008 certification, and is considered as a very successful brand in the UAE.